Providing The Highest Quality Legal Services

We are dedicated to providing the highest quality legal services and personalized attention to each and every one of our clients.

Practice Areas

- Captive Insurance Companies

- Civil and Commercial Litigation

- Commercial Real Estate, Zoning & Land Use

- Corporate and Transactional Law

- Family Law

- Insurance Defense

- Probate Litigation

- Mergers and Acquisitions

- Intellectual Property Law

- Taxation

- Workers’ Compensation

- Employment Law

- Estate Planning

Captive Insurance Companies

Given the various legal complexities that go into a properly operating captive insurance company, MIJS believed it was important to provide a captive management team that consists of attorneys and insurance professionals with expertise in insurance defense/coverage, regulatory compliance, accounting, corporate, and tax.

Civil and Commercial Litigation

The civil litigation department has experienced rapid growth over the last several years. The trial lawyers in this department have developed outstanding reputations for obtaining excellent results for our clients, as well as providing exceptional responsiveness and service to each client regardless of the size or nature of the case.

Commercial Real Estate, Zoning & Land Use

Initiating zoning requests, advice on achievable zoning categories, and handling hearings for zoning and variances through appeals to the courts.

Handling condemnation hearings and appeals, contract arbitration and litigation, and construction disputes.

Handling quiet title actions, mineral rights actions and boundary and title disputes.

Corporate and Transactional Law

As corporate transactions grow more complex, the knowledge and skill of the attorneys handling them becomes increasingly important. Every decision is a critical one, affecting all aspects of the client’s business. Our corporate attorneys take an active role in advising their clients of potential legal problems and how to avoid them.

Family Law

- Professionally and discreetly help clients through domestic relations and family matters, such as divorce, modification of alimony and child support, child custody and contempt.

- Skillfully and expeditiously manage lawsuits involving civil matters.

- Provide ultimate skill and experience in defending persons and corporations accused of crimes, including both misdemeanors and felonies.

- Work in unison with the estate and tax planning department to complete domestic family matters and assure that affairs are well managed.

Insurance Defense

Our insurance defense practice involves representing insurance companies, third-party administrators and self-insureds in defending personal injury and wrongful death claims, with emphasis in the following areas: motor carrier liability, premises liability, product liability, motor vehicle accidents, food poisoning, and other types of general liability and tort claims.

Probate Litigation

Our Probate Litigation department allows our clients to maximize the benefits of the Estate Planning and Civil Litigation departments by assisting our clients all the way through the Probate process.

The particularities of Probate Court Practice demand litigators with specialized knowledge of Court Procedures. The emotional issues and family dynamics surrounding many probate proceeding require careful and thoughtful representation.

Mergers and Acquisitions

In today’s world, mergers, acquisitions, divestitures, spin-offs, split-ups and other business transactions have become more complex due to heavier regulations of businesses, difficulties in access to traditional lending markets and differences among investor risk tolerances.

Intellectual Property Law

As corporate transactions grow more complex, the knowledge and skill of the attorneys handling them becomes increasingly important. Every decision is a critical one, affecting all aspects of the client’s business. Our corporate attorneys take an active role in advising their clients of potential legal problems and how to avoid them.

Taxation

The tax aspects of corporate transactions are intimately involved and carefully considered by the tax department of Moore Ingram Johnson & Steele. With a thorough understanding of the latest tax laws, our tax department provides a comprehensive range of services in the area of taxation, including:

- Individual, partnership, trust and estate taxation

- Employee benefit matters

- State and local taxation

Workers’ Compensation

The firm’s workers’ compensation attorneys represent employers, insurers, self-insured funds in the litigation of disputed workers’ compensation claims throughout the states of Georgia, Tennessee, Kentucky, Florida, & Pennsylvania. Our attorneys appear regularly before Administrative Law judges and the Appellate Division of the State Board of Workers’ Compensation, and the Departments of Labor in handling these claims. We have also successfully defended numerous workers’ compensation claims through appeals before the Court of Appeals in these states.

Employment Law

Moore Ingram Johnson & Steele’s employment law practice involves a full array of employment services, advice and representation in litigation under federal and state employment laws. Moore Ingram Johnson & Steele services its clients in both the litigation and transactional aspects of employment law.Estate Planning

The firm’s estate planning practice has developed into one of the strongest in the metropolitan area of Atlanta, with an average estate client net worth in excess of seven million dollars. Our tax attorneys concentrate in sophisticated estate planning techniques and work closely with each of our clients to effectively accomplish their individual goals.

Compliance with Corporate Transparency Act and Filing Beneficial Ownership Information Reports

The purpose of this correspondence is to inform you about recent developments in federal corporate compliance legislation and how this legislation may affect your business.

The Corporate Transparency Act (the “CTA”), which was enacted January 1, 2021, is aimed at promoting transparency in corporate ownership and preventing illicit activities such as money laundering and terrorism financing. Under the CTA, certain entities are required to disclose their beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of the Treasury.

Unlike most federal legislation, the CTA exempts larger companies but applies to almost all smaller companies. The “large companies” that are exempt are defined as any business with 20 or more employees and more than $5.0 million in annual gross revenue. There are other exemptions listed in the CTA which may apply to your business.

As part of our firm’s commitment to keeping you informed and ensuring your compliance with relevant legal requirements, we want to highlight the importance of adhering to the Beneficial Ownership Information (“BOI”) filing requirement mandated by the CTA (the “BOI Reports”). The BOI Reports require the disclosure of certain personal information of each “beneficial owner” of the business. A beneficial owner is defined as any individual who exercises control over the business (such as an officer, director or manager) or who owns 25% or more of the stock or ownership interests of the business. For companies formed after January 1, 2024, the same information must be disclosed for each “company applicant” of the business. Company applicant is defined as the person who files or is responsible for filing the documents to form the entity. In most cases, the company applicant will be the attorney who set up your business with the state.

As of January 1, 2024 the reporting requirements of the CTA became effective. If your business was formed prior to January 1, 2024, your company has until December 31, 2024 to file the initial BOI Report. However, if your business was formed after January 1, 2024, then your initial BOI Report must be filed within 90 days of the date of incorporation or formation. If any changes occur to the information listed in the initial BOI Report (for example, a change in ownership), your company is required to file an updated report within 30 days of such changes. Any failure to comply with the filing requirements of the CTA may result in a fine of $500 for each day of noncompliance and/or up to 2 year in prison.

Our firm has diligently kept abreast of these legislative changes and we are fully equipped to assist you in fulfilling your filing obligations under the CTA. We understand that navigating regulatory requirements can be complex and time-consuming, so we are offering our support to handle any BOI filings on your behalf. By allowing our firm to manage this process for you, we can ensure that your filings are accurate, timely and in compliance with all applicable regulations. To that end, we will work closely with you to gather the requisite information and submit the filings efficiently.

To be clear, you are permitted to file the BOI Reports on behalf of your business and are not required to use Moore Ingram Johnson and Steele LLP to do so. If you prefer that our law firm file the reports on your behalf, you will need to complete the information set forth in the attached FinCEN CTA Checklist and return the checklist to our office. Unless we hear from you, please be advised that Moore Ingram Johnson and Steele LLP will not make any filings required by the CTA on behalf of your business.

Please do not hesitate to email us at CTA@mijs.com if you have any questions or if you would like to discuss how we can assist you further with your compliance efforts. As always, thank you for entrusting Moore Ingram Johnson and Steele LLP with your legal needs.

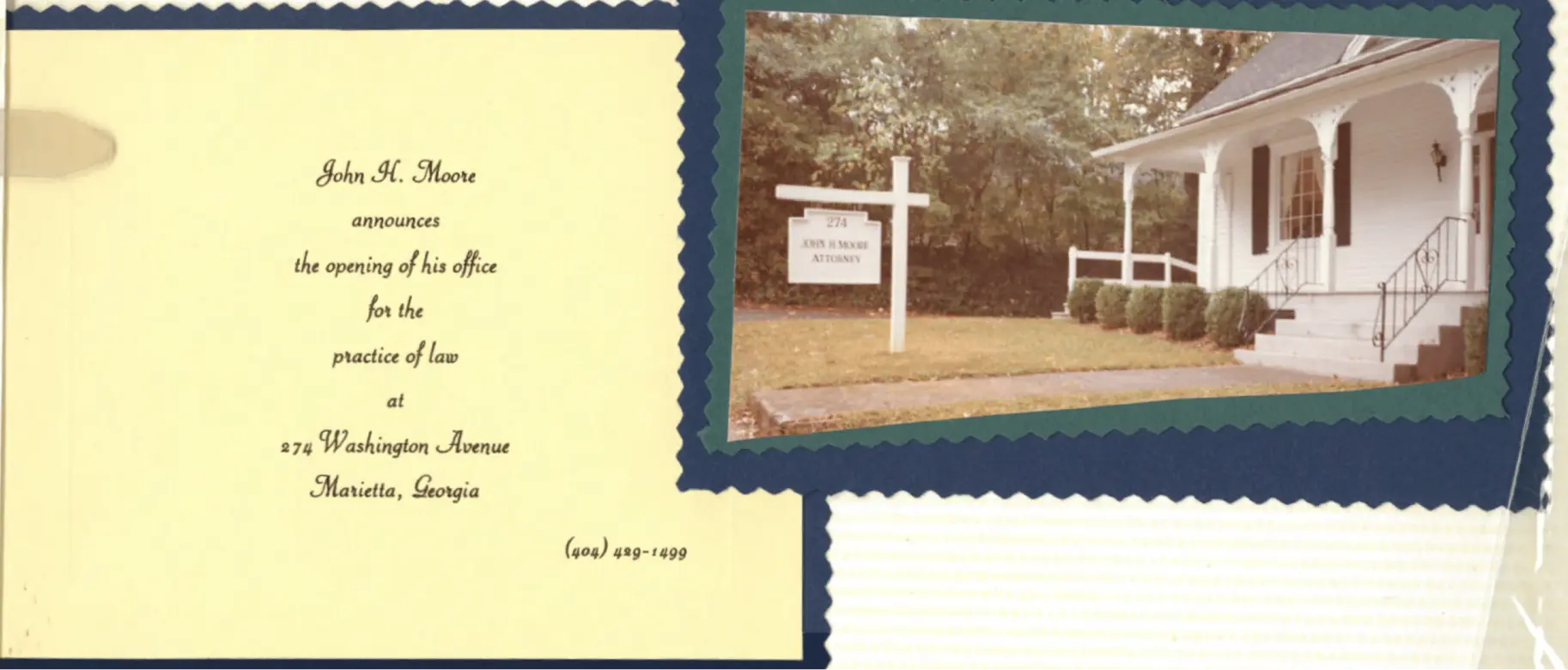

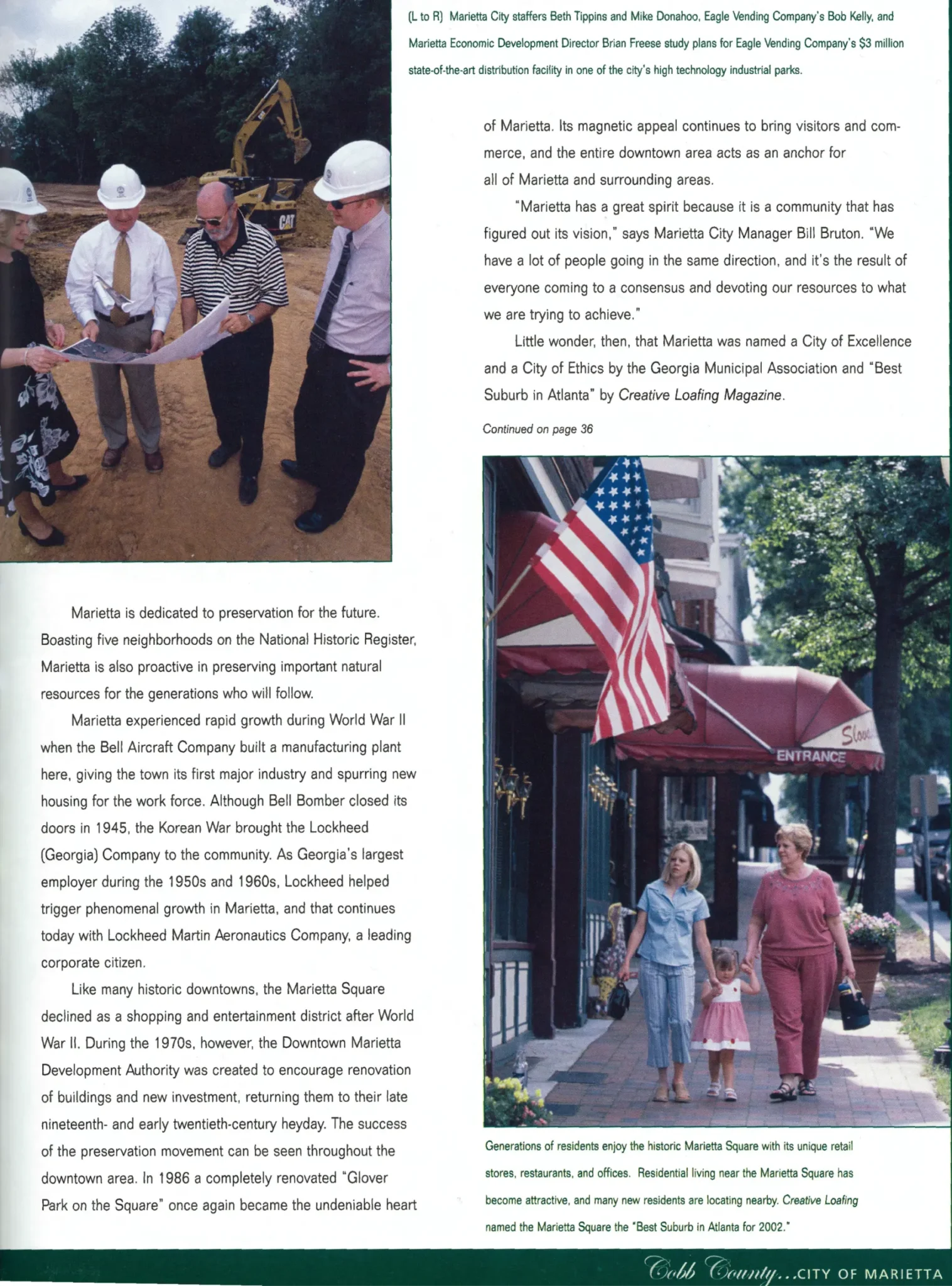

40 Years of Legal Excellence and Community Involvement

A Message from

John H. Moore

Our firm was founded in 1984 with the philosophy that for quality legal representation, a firm must address the law and the specialized needs of each individual client. We are dedicated to providing the best quality legal services and personalized attention to each and every one of our clients. We believe that our clients deserve no less.

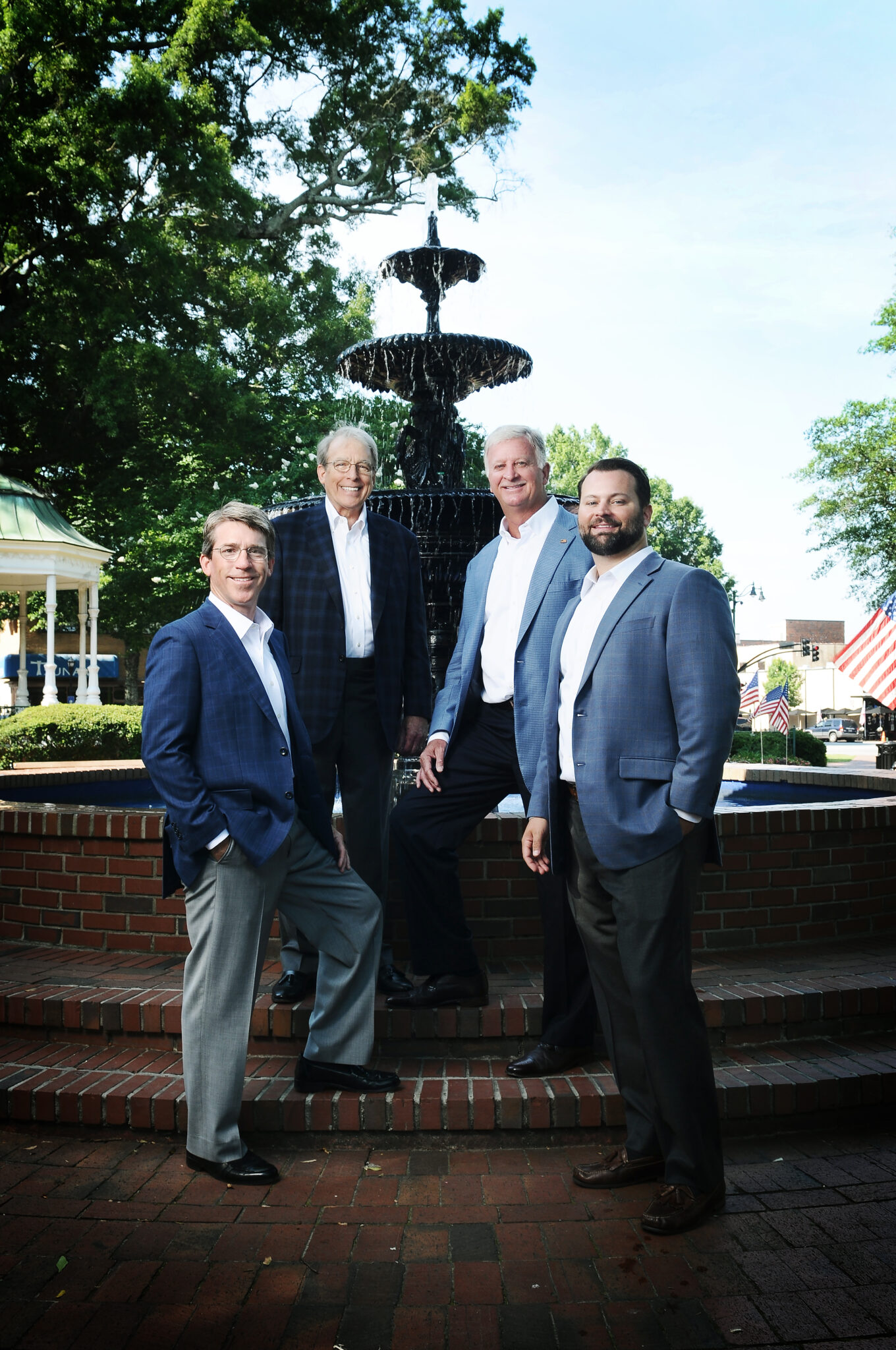

Our Firm

Moore Ingram Johnson & Steele, LLP is a full service law firm providing legal advice to its clients in virtually all aspects of Captive Insurance Company Formation and Management; Civil Litigation and Commercial Litigation; Commercial Real Estate, Zoning and Land Use; Corporate and Transactional Law; Estate Planning; Employment Law; Family Law; Insurance Defense; Intellectual Property; Merger and Acquisition; Taxation and Workers’ Compensation.

MIJS Locations

With many areas of specialization, you will find that we are still personalized in each one. By providing our clients with a full range of services, we are able to support them in almost any legal situation they may encounter. Above all, we are committed to representation in the most professional manner possible and dedicated to service that is as individual as each client.

When Experience Counts

Our Philosophy at Moore Ingram Johnson & Steele is, we believe that for quality legal representation, a firm must address the law and the specialized needs of each individual client. We are dedicated to providing the best quality legal services and personalized attention to each and every one of our clients. We believe that our clients deserve no less. Our Firm was founded in 1984 with that philosophy and it remains the very core of our practice today. An exceptional degree of service is what sets us apart from other firms and enables us to form long-term, beneficial relationships with our clients.

What Our Clients Have to Say...